Our Standard package provides essential formation documents, while the Pro package includes advanced features and ongoing support.

General Partnership Business Name Registration

₦30,000.00

Register Your Nigerian General Partnership Business Name

General Partnership Registration (GP) Packages

Our Process

Choose a Package: Select your desired package and complete the secure online payment.

Provide Information: Submit your company details through our quick online form.

Process Your Application: We handle the filing and processing with the CAC.

Receive Documents: Get your CAC-approved business registration documents.

Why Choose us?

Fast & Efficient: Complete your registration in minutes with our streamlined digital platform.

Expert Support: Work with CAC-accredited agents and Chartered Secretaries for a seamless process.

Transparent Pricing: Enjoy clear, upfront pricing with no hidden fees.

Secure & Reliable: Trust us to protect your private information.

Requirements for General Partnership Business Name Registration

Here are the requirements for registering a GP with the CAC:

Proposed Business Names: At least two (2) options (1st choice and alternative).

Partner / Proprietors Information: A General Partner must have at least two partners and a maximum of 20. Provide all partners' full names, addresses, occupations, and means of identification.

Business Objectives: Specify the objectives and nature of the business activities the partnership will engage in.

Business Address: A registered address for the partnership in Nigeria, where the business operates or receives correspondence.

Partnership Agreement: While not required for registration, having a partnership agreement that outlines roles, responsibilities, profit-sharing, and management is highly recommended.

Features of General Partnership Business Name

Here are the key features of a GP:

Unlimited Liability: Proprietors/Partners are personally liable for all business debts and obligations, putting their personal assets at risk.

No Corporate Tax: A general partnership is a pass-through entity; it does not pay income taxes. Instead, each partner reports their share of the partnership's profits or losses on their tax return.

No Legal Distinction: The business and its Proprietors (Partners) are legally considered the same entity, meaning there is no separate legal structure.

Partnership Agreement: Not legally required but recommended to define roles, profit-sharing, dispute resolution, and procedures for adding or removing partners.

Number of Partners: A General Partnership must have at least two partners. There is a maximum limit of 20 partners.

Benefits of General Partnership Registration

Here are the key benefits of registering a General Partnership Business Name:

Legal Recognition: Registration with the CAC provides legal recognition, allowing the partnership to operate formally and engage in contracts under a recognized business name.

Enhanced Credibility: A registered business name builds trust with clients, suppliers, and financial institutions, as it demonstrates legitimacy and compliance with legal requirements.

Shared Liability: While each partner is personally liable, the shared responsibility can sometimes reduce the risk of individual losses.

Raising Capital: It is easier to raise capital by admitting new partners. Existing partners can contribute additional capital as needed.

Protection of Business Name: Registration protects the business name, preventing other entities from using it within Nigeria.

Access to Banking and Financial Services: With a registered business name, the partnership can open a business bank account.

FAQs

Frequently asked questions about General Partnership Business Name Registration in Nigeria:

A General Partnership is a business owned and operated by two or more individuals or entities who share profits, responsibilities, and liabilities.

Unlike corporations, general partnerships do not have a separate legal identity from the partners, meaning each partner has unlimited liability for the business's debts and obligations.

The registration process timeline varies depending on CAC and processing efficiency. This is the timeline:

Name Search and reservation: 6 - 24 hours from submission.

Grant of Certificate of Registration: 24 -96 Hours from filing.

Total time: Approximately 2 - 7 days.

While a written partnership agreement is not legally required, it is highly recommended that it outline the partnership's terms, including profit distribution, capital contributions, and operating procedures.

A General Partnership is a pass-through entity, meaning profits and losses are passed through to the partners, who report them on their individual tax returns. This avoids double taxation.

In a General Partnership, all partners have unlimited personal liability for the debts and obligations of the business. This means their personal assets can be used to cover any business losses.

Blog

We've put together some articles that might interest you:

Register General Partnership Business Name in Nigeria

Here's how SplashDict's team of CAC-accredited consultants can help:

Business Name Registration: Nigerian General Partnership Business Name Registration with the CAC.

Documentation Preparation: We handle all required registration documents.

Business Name Search and Reservation: We check availability and secure your desired business name.

CAC Filing Fee Included: No hidden costs; package price covers all fees.

Submission and Processing: We manage the entire process for swift approval.

TIN Assistance: Tax Identification Number issued upon registration.

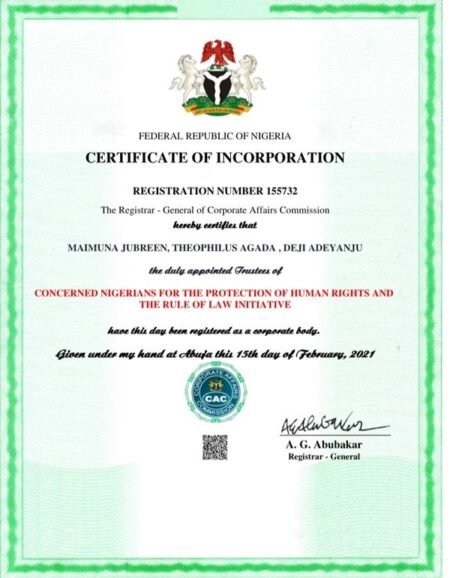

Documents Delivery: Receive your Certificate of Registration and Status Report.

Ongoing Secretarial Support for statutory filings and compliance.