Experience a hassle-free registration process with SPlashDict:

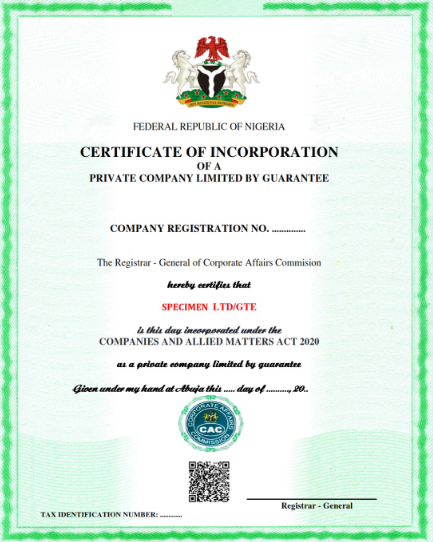

Company Limited by Guarantee Incorporation

₦80,000.00

Incorporation of Guarantee Company (Ltd/Gte) in Nigeria

This type of company is a non-profit organization, similar to an Incorporated Trustee, but it is registered as a company with the CAC.

A guarantee company entity is often used by charities, but not all companies limited by guarantee are charitable. Other common uses for this type of company are membership organizations and clubs, including sports associations.

It has members instead of shareholders, and its activities are restricted to those that are set out in its memorandum and articles of association. The company's members limited by guarantee are not liable for the company's debts, but they may be required to contribute to the company's assets if it is wound up.

Upon completing the order, you’ll be redirected to submit your information to process your registration.

Our Process

Choose a Package

Select a package, add to cart, and complete secure online payment.

Provide Information

Fill out our simple online form with your business details.

We Process Your Application

We'll prepare and file the necessary documents with the CAC.

Receive Documents

Get your completed business entity package.

Register your Private Guarantee Company in Nigeria

Here's how SplashDict's team of CAC-accredited consultants can help:

Company Registration: Nigerian Company Limited by Guarantee Registration with the CAC.

Documentation Preparation: Our experts handle all necessary registration documents including the Memorandum and Articles of Association.

Business Name Search and Reservation: We check availability and secure your desired company name.

CAC Filing Fee Included: No hidden costs, everything is included in the package price.

First Board Meeting Minutes Provided: We will prepare the legally required meeting minutes for your first board meeting.

Submission and Processing: We ensure all requirements are met and manage the submission process for efficient approval by the CAC.

Newspaper Publication: We handle the mandatory public notice publication in two national dailies, including details of the association and trustees.

Tax Identification Number (TIN): Issued upon incorporation.

Documents Delivery: Receive copies of your Certificate of Incorporation, approved MEMART, CAC Status Report, and Company Register.

Company Secretarial Support: We offer ongoing secretarial services to support your company with statutory compliance and filings for the first year.

Requirements for Private Guarantee Company Registration

Here are the requirements for Incorporating a Nigerian Private Company Limited by Guarantee Company with the CAC:

Two (2) proposed company names in order of preference (1st choice and an alternative).

Business Nature: Classification and description of the company’s non-profit objectives.

Address, phone number, postal address, and email of the company.

Details of Directors, Guarantors, witness and secretary such as name, occupation, address, phone number, email, valid means of identification, passport photograph and signature.

At least one named guarantor and one director who is resident in Nigeria must be present. It is acceptable for the same person to act in both capacities.

Persons with Significant Control: Details of individuals or entities that hold significant control (own or control more than 25% of voting rights or activities of the company).

Statement of Guarantee: Each guarantor must state the amount they guarantee to contribute upon winding up of the company.

Memorandum and Articles of Association (MEMART): Document outlining the company's objectives, rules, and including a property and contribution clause of at least ₦100,000 for winding up.

Attorney General's Authorization: The AGF approval is necessary for registration. If no decision is made within 30 days, a notice will be placed in three national newspapers for public objections.

Features of a Private Guarantee Company (Ltd/Gte)

How Does a Guarantee Company Work?

Non-Profit Status: Similar to Incorporated Trustees, a Private Company Limited by Guarantee is established for non-profit purposes, such as charitable, religious, educational, or social activities.

Ownership and Structure: The company is owned by its members, referred to as guarantors, rather than shareholders.

A minimum of one director and one guarantor is required to form the company. The same individual can serve as both guarantor and director.

No Share Capital: The company does not have share capital. Instead of shareholders, it has members who act as guarantors. These guarantors agree to contribute a nominal amount in case the company is wound up, protecting personal finances.

Limited Liability for Members: Members (guarantors) have limited liability, meaning their financial responsibility is restricted to the amount they guarantee to contribute during winding up. This protects their personal assets from company debts beyond this agreed sum.

No Dividends to Members: Since the company operates on a non-profit basis, profits are not distributed as dividends to members. Any surplus or profit earned by the company is reinvested into promoting its non-profit objectives.

Corporate Personality:It can carry out activities in the name of the company such as employing human resources, borrowing credit, buying and sell of property and defending a lawsuit, entering into contracts.

MEMART: The company is governed by its Memorandum and Articles of Association (MEMART), which outlines its objectives, rules, governance structure, and operational procedures.

Consent Requirements: Requires Registrar-General's consent or publication in two newspapers inviting objections.

Compliance: The company is required to file annual returns with the CAC just like a private limited liability company.

Guarantee Company Incorporation Package

Find the best package to start your Trust:

Benefits of Private Guarantee Company Registration

Incorporating as a Private Company Limited by Guarantee (LTD/GTE) offers several advantages including:

Facilitates Non-Profit Status: Ideal for charities and non-profit organizations where profits are reinvested rather than distributed.

Limited Liability: Members' liability is limited to the amount they guarantee, protecting personal assets from company debts.

Corporate Status: As a separate legal entity, the company can hold property, employ staff, and build trust with clients, funders, and stakeholders.

Operational Flexibility: Suitable for special purposes with the ability to enter contracts, sue, be sued, and operate nationwide.

Tax Benefits: Eligible for tax exemptions and relief, with liability only arising for commercial activities exceeding VAT thresholds.

Intrinsic Rewards: Members and employees are personally committed to the organization’s cause, fostering dedication and community support.

Access to Funding: Guarantee Companies may be able to access grants, donations, and other forms of funding more easily than unincorporated associations.

Perpetual Succession: The company continues to exist even if members change, ensuring continuity and stability.

Exclusive Name Protection: Registration secures your organization's name, preventing similar names from being registered by others.

Why Choose SplashDict for CAC Guarantee Company Registration?

We streamline your Trusteeship setup process with efficient service.

Expert Team

Our team of Chartered Secretaries ensures seamless business setup.

CAC-Accredited Agents

Our team of CAC-accredited agents ensures seamless and compliant registration.

Transparent Pricing

Clear and upfront pricing with no hidden fees.

Fast & Efficient

Experience fast and easy registration with our streamlined online platform.

Secure & Reliable

Robust security measures protecting your data and documents.

Dedicated Support

Receive continuous support from our team throughout and beyond the registration process.

FAQs

Frequently asked questions about Incorporation of Company Limited By Guarantee (Ltd/Gte) in Nigeria:

A private company limited by guarantee does not have shares or shareholders but members who guarantee a certain amount towards the company’s liabilities in the event of insolvency. Members do not contribute capital unless the company is winding up.

It shares many features with private companies limited by shares, including legal independence, and the ability to own assets, and employ staff.

This structure is commonly used by charities, non-profits, public sector bodies, and organizations that don’t require significant capital or intend to reinvest profits.

While it can run profit-making businesses, a company limited by shares is typically more suitable for such ventures due to its financial flexibility.

A company limited by guarantee differs from a company limited by shares primarily in terms of ownership and liability. In a company limited by guarantee, there are no shareholders; instead, it has members who guarantee a specific amount to be paid if the company is wound up.

These companies are typically used for non-profit or charitable purposes, and members do not contribute capital unless the company faces insolvency.

In contrast, a company limited by shares has shareholders who own the company by holding shares. Shareholders invest capital into the business and may receive dividends from profits. Their liability is limited to the amount unpaid on their shares, meaning they risk losing only what they've invested.

Company guarantors are individuals (or corporate bodies) who agree to become members of a limited by guarantee company, promising to pay a fixed sum of money (a ‘guarantee’) in the event that the company cannot pay its debts, and making important decision about how the company is run.

Generally, guarantors do not take any profit, because surplus income is instead used for the good of the company and its non-profit or charitable aims.

Almost anyone can be a company guarantor (member), including individuals, groups of people, and other companies and organizations.

There are no restrictions based on age or qualifications unless you include such provisions in the articles of association. However, anyone who becomes a member must, of course, be able to fulfill the financial and decision-making obligations of a company guarantor.

Unless the company’s articles of association state to the contrary, you must have a minimum of one member (guarantor) and one director to set up a limited-by-guarantee company, and there is no upper limit. The same person can hold both positions, or you can appoint different people to each role.

A company guarantor can also be a director of the same company, on condition that the individual is at least 16 years old and is not subject to the restrictions of director disqualification, bankruptcy, or a Debt Relief Order.

The main reason to set up a company limited by guarantee is to provide financial protection to people who run a charity, community project, or some other form of non-profit venture.

By operating through a company, members have limited personal liability for the debts of the enterprise. Additionally, some funding bodies and charity regulators require charities and non-profits to be registered as a company.

To set up a limited-by-guarantee company, you need to file an application to incorporate at CAC. You can do this online through SPlashDict, using our tailor-made Limited by Guarantee package.

As an accredited CAC agent, our experienced team is on hand to provide help and advice throughout the registration process and beyond.

Your application will be reviewed by us before electronic submission to CAC, reducing the risk of rejection. Once approved, you will receive copies of your new company documents and you can begin trading at any point thereafter.

If the Attorney General does not respond within 30 days, the promoters must place a notice in three national newspapers inviting public objections. If no objections are raised, the company can proceed with the incorporation process.

Blog

We've put together some articles that might interest you: